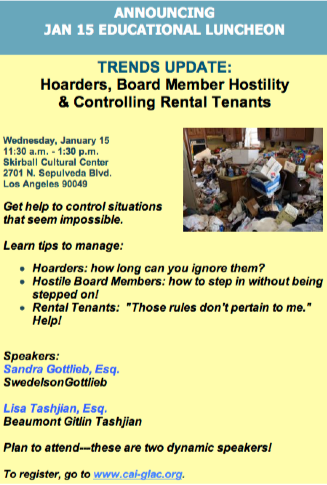

Sandra Gottlieb will appear as a co-presenter on the CAI-GLAC’s luncheon program, Trends Update: Hoarders, Board Member Hostility and Controlling Rental Tenants on Wednesday, January 15 at 11:30 a.m. at the Skirball Cultural Center in Los Angeles. Topics include:

Sandra Gottlieb will appear as a co-presenter on the CAI-GLAC’s luncheon program, Trends Update: Hoarders, Board Member Hostility and Controlling Rental Tenants on Wednesday, January 15 at 11:30 a.m. at the Skirball Cultural Center in Los Angeles. Topics include:

New Davis-Stirling Act & Reserve Funding — Updated Law Amounts to New Set of Civil Code References for Reserve Funding Matters

By Robert Nordlund, Association Reserves and David Swedelson, SwedelsonGottlieb

The body of statutory law (as opposed to case law) governing California Community Associations, known as the Davis-Stirling Common Interest Development Act, went into effect on January 1, 1986. As the industry developed and matured over the last 27 years, approximately 50 changes and amendments were made to the Act. While those adjustments were well-intended, the net effect yielded a disorganized and confusing body of law. To address this problem, a multi-year effort was launched to rewrite the Davis-Stirling Act. This “new” Davis-Stirling Act, signed into law in 2012, becomes the guiding law for California residential community associations on January 1, 2014. So you are probably asking what are the major changes and how does the re-write affect reserve funding issues? The answer is no major changes have been made regarding reserve funding. For the most part, the new updated law amounts to new set of Civil Code references for reserve funding matters. Fortunately, the majority of the changes are just re-organization and renumbering. But there have been changes made to the Act as it applies to reserves.

The body of statutory law (as opposed to case law) governing California Community Associations, known as the Davis-Stirling Common Interest Development Act, went into effect on January 1, 1986. As the industry developed and matured over the last 27 years, approximately 50 changes and amendments were made to the Act. While those adjustments were well-intended, the net effect yielded a disorganized and confusing body of law. To address this problem, a multi-year effort was launched to rewrite the Davis-Stirling Act. This “new” Davis-Stirling Act, signed into law in 2012, becomes the guiding law for California residential community associations on January 1, 2014. So you are probably asking what are the major changes and how does the re-write affect reserve funding issues? The answer is no major changes have been made regarding reserve funding. For the most part, the new updated law amounts to new set of Civil Code references for reserve funding matters. Fortunately, the majority of the changes are just re-organization and renumbering. But there have been changes made to the Act as it applies to reserves.

To read the article prepared by David Swedelson and Robert Nordlund, follow this link.

If San Rafael Can Restrict Smoking In Units, So Can Your Condo Association

By David Swedelson, Senior Partner, SwedelsonGottlieb, Community Association Attorneys

San Rafael, a city just north of San Francisco, recently made active a smoking ban which prohibits smoking cigarettes inside any dwelling that shares a wall with another unit and this would include condominiums. It is considered the strictest smoking ban in the country. Follow this link to read the story.

San Rafael, a city just north of San Francisco, recently made active a smoking ban which prohibits smoking cigarettes inside any dwelling that shares a wall with another unit and this would include condominiums. It is considered the strictest smoking ban in the country. Follow this link to read the story.

San Rafael made it clear that it is the City’s hope to eliminate secondhand smoke from creeping through doors and windows, ventilation systems, floorboards another susceptible openings. Boards and managers for condo associations tell us that they want to do the same thing. What we tell them is that they can, if they are willing to invest the necessary time and effort.

Condominium associations have approached us regarding an amendment to their CC&Rs that would prohibit smoking within the units themselves. Many of our condominium association clients already have bans on smoking in the common area as the board has the power and authority to make rules regarding use of the common area. But when it comes to restricting smoking within a unit itself, that must be done by an amendment to the CC&Rs.

Continue reading

Lincoln Fourscore, Gobbledygook 0; For Condo/HOA/Stock Coop Board Members and Managers, Choosing the Right Words Can Make The Difference

By David Swedelson, Attorney, Partner at SwedelsonGottlieb, Community Association Attorney/Writer/Blogger

How clear is your writing? Do you spend time editing to make sure that your message is clear and concise? Are your communications rambling? Sometimes community association managers or board members think that writing in legalese will impress their attorneys. Or that using long, technical or sophisticated words will sway homeowners to action. Long words and too many of them can make all of us feel like we’re spinning around in the endless loop of the old Abbott and Costello “Who’s On First?” routine. How do you get off that not-so-merry-go-round?

How clear is your writing? Do you spend time editing to make sure that your message is clear and concise? Are your communications rambling? Sometimes community association managers or board members think that writing in legalese will impress their attorneys. Or that using long, technical or sophisticated words will sway homeowners to action. Long words and too many of them can make all of us feel like we’re spinning around in the endless loop of the old Abbott and Costello “Who’s On First?” routine. How do you get off that not-so-merry-go-round?

“Less is more” is a lesson we can all learn from President Abraham Lincoln. Why am I saying this now? I read a very interesting op-ed essay in the Los Angeles Times, written by Ronald C. White Jr., a Fellow at the Huntington Library, and a visiting Professor of History at UCLA. He is also the author of a book entitled A. Lincoln: A Biography.

The focus of the op-ed essay was Lincoln (no surprise there) and the fact that the Gettysburg Address, which Lincoln gave 150 years ago, on November 19, 1863, is a testament to the power of choosing your words. Follow this link to read the op-ed piece.

Continue reading

Delinquent HOA Owner Files A Chapter 13 Bankruptcy That Is Converted To A Chapter 7; In a Converted Bankruptcy, Which Date Controls, the Filing Date or the Conversion Date?

By SwedelsonGottlieb, Community Association Attorneys

At some point, just about every community association will have a delinquent owner who files for bankruptcy. And while a bankruptcy filing is often interpreted as meaning that the debt has become uncollectable, it does not necessarily mean the end of the road for creditors, especially homeowners associations. There are special provisions for homeowners associations in the Bankruptcy Code that may help an association, assuming the association has recorded a lien, and collection of the delinquent assessments may still be possible. Having an attorney who is familiar with bankruptcy law involved at the outset of the case can drastically improve an association’s chances of recovering the money it is owed. Some bankruptcies are quick and easy. Some are not. Some start out looking like they will be quick and easy, and then things change. This article is about the ones that change when a delinquent homeowner’s bankruptcy is converted from one type of bankruptcy to another.

At some point, just about every community association will have a delinquent owner who files for bankruptcy. And while a bankruptcy filing is often interpreted as meaning that the debt has become uncollectable, it does not necessarily mean the end of the road for creditors, especially homeowners associations. There are special provisions for homeowners associations in the Bankruptcy Code that may help an association, assuming the association has recorded a lien, and collection of the delinquent assessments may still be possible. Having an attorney who is familiar with bankruptcy law involved at the outset of the case can drastically improve an association’s chances of recovering the money it is owed. Some bankruptcies are quick and easy. Some are not. Some start out looking like they will be quick and easy, and then things change. This article is about the ones that change when a delinquent homeowner’s bankruptcy is converted from one type of bankruptcy to another.

Continue reading

When Fido Goes Rogue: How Does Your HOA Deal With Dangerous Dogs?

By David Swedelson, Condo Lawyer, HOA Attorney, Partner at SwedelsonGottlieb, and Dog/Pet Lover

According to an article in the Tuesday, November 5, 2013 edition of the Los Angeles Times (follow this link for the article), Orange County supervisors are debating a proposal to create a website showing where every dangerous offender in the county is located. Not human — canine. The website would do for dogs what Megan’s Law does for sex offenders. County supervisors believe that citizens have the right to know where both are located.

According to an article in the Tuesday, November 5, 2013 edition of the Los Angeles Times (follow this link for the article), Orange County supervisors are debating a proposal to create a website showing where every dangerous offender in the county is located. Not human — canine. The website would do for dogs what Megan’s Law does for sex offenders. County supervisors believe that citizens have the right to know where both are located.

How serious is the problem? In 2012, Orange County Animal Care investigated 264 dangerous dog reports, which led to 66 dogs being euthanized — fully 25 percent. There were also 2,281 reports of dog bites in the O.C. area. We can only assume that other counties in California have just as serious a problem as OC has reported.

Continue reading

The Delinquent HOA Owner Filed a Chapter 7 – Is it an “Asset” Bankruptcy or a “No Asset” Bankruptcy?

By SwedelsonGottlieb, Community Association Attorneys

As you likely know, there are different types of bankruptcies that an individual can file. Typically, we see delinquent owners file either a Chapter 13 bankruptcy seeking to readjust their debts, or a Chapter 7 bankruptcy where the owner is seeking to liquidate their assets and eliminate their unsecured debts. This article will deal exclusively with Chapter 7 bankruptcies.

As you likely know, there are different types of bankruptcies that an individual can file. Typically, we see delinquent owners file either a Chapter 13 bankruptcy seeking to readjust their debts, or a Chapter 7 bankruptcy where the owner is seeking to liquidate their assets and eliminate their unsecured debts. This article will deal exclusively with Chapter 7 bankruptcies.

Chapter 7 bankruptcies are generally the simplest of all bankruptcy cases, but that doesn’t mean that there aren’t important distinctions to be made on a case-by-case basis which could affect a creditor’s claim. The most common and most important distinction to be made in a Chapter 7 bankruptcy is whether it is an “Asset” case or a “No Asset” case. To understand what this means, you need to know a little bit about how a Chapter 7 bankruptcy works.

Continue reading

Can Your Condo Association Be Sued For Failure to Obtain FHA Certification? Maybe! Be Sure To Document The Board’s Decision

By David Swedelson and Sandra Gottlieb, Senior Partners at SwedelsonGottlieb, Community Association Attorneys

We are often asked if a condo or homeowners association is required to obtain FHA certification. And unless the CC&Rs make such a requirement (most do not), we generally respond with a resounding “NO!” But what has not been considered, at least until now, is whether a community association is required to even consider the matter. The answer is maybe.

Some may be asking what the heck “FHA certification” means. In 2010, the Federal Housing Association (FHA) stopped giving spot loan approval and has been requiring that condominium developments themselves become approved if the FHA is to provide mortgage insurance within the development. The FHA, a government-owned loan/mortgage insurer, does not loan money; it insures loans made for buyers who cannot afford a conventional down payment. FHA insured loans now account for more than half of all new home loans. With an FHA insured loan, buyers can purchase a condo unit with a lower down payment (3.5% of the purchase price vs. 20% for conventional loans), lower closing costs, easier credit qualifying, with loans up to $625,500 (depending on the county where the unit is located). So FHA insured loans appeal to lower income buyers.

Continue reading

Scared of the New Davis-Stirling Act? Have No Fear!

Have you seen our videos from our recent event, “What’s New in the Davis-Stirling Act?” SwedelsonGottlieb Senior Partner Sandra Gottlieb explains it all for you – we’ve edited some video into sweet bite-sized sections. Follow the link below to access our videos and enjoy!

Continue reading

Liability and the Service-Oriented Manager/Association

By Sandra Gottlieb, Esq., Swedelson Gottlieb, Community Association Attorneys

We recently attended a very informative program put on by Community Association Institute’s Greater Los Angeles Chapter titled The Service-Oriented Manager, and we were reflecting on all of the amazing services that many community managers provide for their community association owners and residents. Of course, as attorneys, we considered the potential liability to which some of these services can expose an association. For example, the speakers were talking about car washing, driver services and faxing documents for residents. And we questioned whether the manager (or the board for that matter) of an association that, for example, provides fax service for the residents, would allow the residents to receive faxes or other personal services without a signed Release and Indemnity Agreement.

We recently attended a very informative program put on by Community Association Institute’s Greater Los Angeles Chapter titled The Service-Oriented Manager, and we were reflecting on all of the amazing services that many community managers provide for their community association owners and residents. Of course, as attorneys, we considered the potential liability to which some of these services can expose an association. For example, the speakers were talking about car washing, driver services and faxing documents for residents. And we questioned whether the manager (or the board for that matter) of an association that, for example, provides fax service for the residents, would allow the residents to receive faxes or other personal services without a signed Release and Indemnity Agreement.

For example, with respect to faxing of documents, what if the association’s staff failed to deliver to a resident an important fax, and as a result, the resident claims they suffered damage? Or what about a staff member who fails to recognize that a fax did not go through or was sent to the wrong fax number? We trust you get the point, and this does not apply just to faxes.

Continue reading