By David Swedelson, Condo Lawyer and HOA Attorney; Partner at SwedelsonGottlieb, Community Association Attorneys

I know that many condominium association boards of directors contemplate the idea of making owners responsible for the waterproofing on the balconies or decks in condominiums (and yes, generally the association is responsible for repairing or replacing what is considered common area waterproofing). Bad idea. The reality is that owners will not do what is required to ensure that the waterproofing is properly maintained and the resulting leaks will allow water to damage the common area and other units. One association client learned this the hard way.

I know that many condominium association boards of directors contemplate the idea of making owners responsible for the waterproofing on the balconies or decks in condominiums (and yes, generally the association is responsible for repairing or replacing what is considered common area waterproofing). Bad idea. The reality is that owners will not do what is required to ensure that the waterproofing is properly maintained and the resulting leaks will allow water to damage the common area and other units. One association client learned this the hard way.

Continue reading

Think your condo association has no obligation to address secondhand smoking nuisance complaints? Think again.

Think your condo association has no obligation to address secondhand smoking nuisance complaints? Think again.  There have been a number of articles written over the last few years regarding the fact that municipalities do not have the money or resources to repair sidewalks broken up by tree roots. There had been some programs in some California cities that would reimburse homeowners up to one half the cost of repairing sidewalks that have been damaged by tree roots. But as a result of the weakened economy, these programs are not funded, and there is no money to reimburse owners.

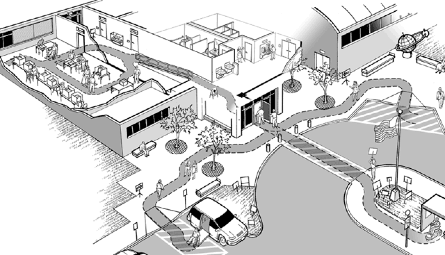

There have been a number of articles written over the last few years regarding the fact that municipalities do not have the money or resources to repair sidewalks broken up by tree roots. There had been some programs in some California cities that would reimburse homeowners up to one half the cost of repairing sidewalks that have been damaged by tree roots. But as a result of the weakened economy, these programs are not funded, and there is no money to reimburse owners.

According to an

According to an  On occasion, we deal with slope and water runoff issues, as a result of poorly installed drainage or otherwise, between neighboring associations, a sub and a master association, or with owners. We have found that it is a common misconception that the law provides that where neither party has done anything to specifically cause or exacerbate the water runoff, the upstream property owner has a responsibility to take care of any damage suffered by the downstream property owner as a result of the runoff. The concept that the upstream property owner is strictly liable for the runoff of water emanating through or by its property is not correct. This misconception appears to be the result of confusion between the traditional rule of liability with the current law on liability as it relates to real property matters.

On occasion, we deal with slope and water runoff issues, as a result of poorly installed drainage or otherwise, between neighboring associations, a sub and a master association, or with owners. We have found that it is a common misconception that the law provides that where neither party has done anything to specifically cause or exacerbate the water runoff, the upstream property owner has a responsibility to take care of any damage suffered by the downstream property owner as a result of the runoff. The concept that the upstream property owner is strictly liable for the runoff of water emanating through or by its property is not correct. This misconception appears to be the result of confusion between the traditional rule of liability with the current law on liability as it relates to real property matters. Have you heard the latest regarding new required pool signage at California community association pools? Our attorneys have been receiving a lot of inquiries about whether a new “poop sign” is required to be posted at community associations that have pools. We have to report that a diarrhea sign is now required. In 2012, the California Building Standards Code (the “Code”) was amended, effective September 1, 2012. The Code states that it applies to “public pools.” At first glance, one would think that just as the Americans with Disabilities Act does not generally apply to community associations,

Have you heard the latest regarding new required pool signage at California community association pools? Our attorneys have been receiving a lot of inquiries about whether a new “poop sign” is required to be posted at community associations that have pools. We have to report that a diarrhea sign is now required. In 2012, the California Building Standards Code (the “Code”) was amended, effective September 1, 2012. The Code states that it applies to “public pools.” At first glance, one would think that just as the Americans with Disabilities Act does not generally apply to community associations,  Attorneys from the law firm SwedelsonGottlieb and Association Lien Services (“ALS”) attended California Association of Community Managers’ (“CACM”) 2013 Northern California Law Seminar in January of 2013. One of the programs dealt with assessment collection strategies. We did not like everything that we heard. This post is intended to set out our thoughts and opinions which differ from the attorney speaker’s opinions with regard to assessment collection strategies.

Attorneys from the law firm SwedelsonGottlieb and Association Lien Services (“ALS”) attended California Association of Community Managers’ (“CACM”) 2013 Northern California Law Seminar in January of 2013. One of the programs dealt with assessment collection strategies. We did not like everything that we heard. This post is intended to set out our thoughts and opinions which differ from the attorney speaker’s opinions with regard to assessment collection strategies. Unless you have been sleeping with Rip Van Winkel for 20+ years (and if you have been, then maybe you have a disability), you are likely aware that there are a number of laws that deal with the rights of disabled individuals to be accommodated. This would include the Americans with Disabilities Act (“ADA”) and the Federal Fair Housing Act (“FFHA”) as well as California Fair Housing Act (“CFHA”). These laws deal with public and private facilities, and to some extent include condominium and homeowner associations. These laws address who is responsible for making modifications or changes to common area to accommodate individuals with disabilities – the owner or the association. It is important to understand the distinctions in the law, as many disabled individuals may insist that their community association is obligated to comply with the ADA, and that can be expensive as well as complicated. The fact is that the ADA likely does not apply to your association. See my prior article entitled

Unless you have been sleeping with Rip Van Winkel for 20+ years (and if you have been, then maybe you have a disability), you are likely aware that there are a number of laws that deal with the rights of disabled individuals to be accommodated. This would include the Americans with Disabilities Act (“ADA”) and the Federal Fair Housing Act (“FFHA”) as well as California Fair Housing Act (“CFHA”). These laws deal with public and private facilities, and to some extent include condominium and homeowner associations. These laws address who is responsible for making modifications or changes to common area to accommodate individuals with disabilities – the owner or the association. It is important to understand the distinctions in the law, as many disabled individuals may insist that their community association is obligated to comply with the ADA, and that can be expensive as well as complicated. The fact is that the ADA likely does not apply to your association. See my prior article entitled